Convertible Bonds Advantages and Disadvantages

Disadvantages of foreign currency convertible bond. Therefore the bullet bond.

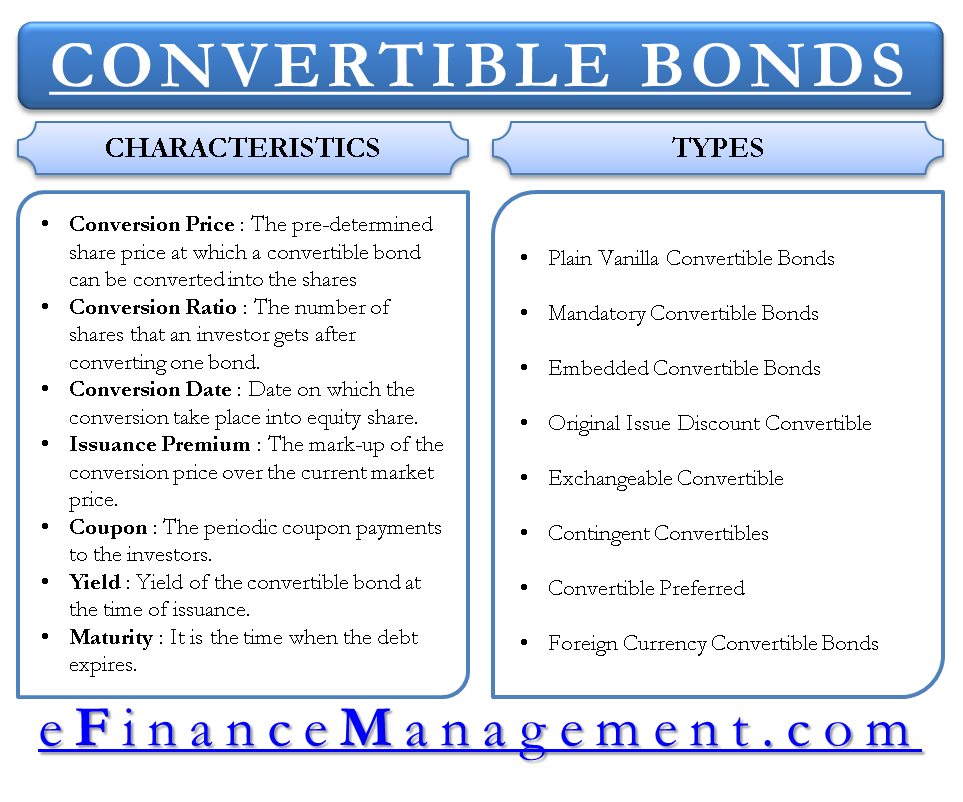

Convertible Bonds Primer On Conversion Features Of Debt Securities

The main advantages which attract investors to reverse convertible bonds have been listed below.

. If the bond is callable the issues has a second advantage. You might have to make periodic interest payments that could increase if the loan has an adjustable interest rate. A convertible debenture is a bond that may be exchanged for stock at a particular point in time by the investor or the issuing company.

Convertible bond and conversion. This can lead to further difficulties for the company in availing any line of credit from a financial institution for. More risk of volatility of the market as more than one economy come into picture.

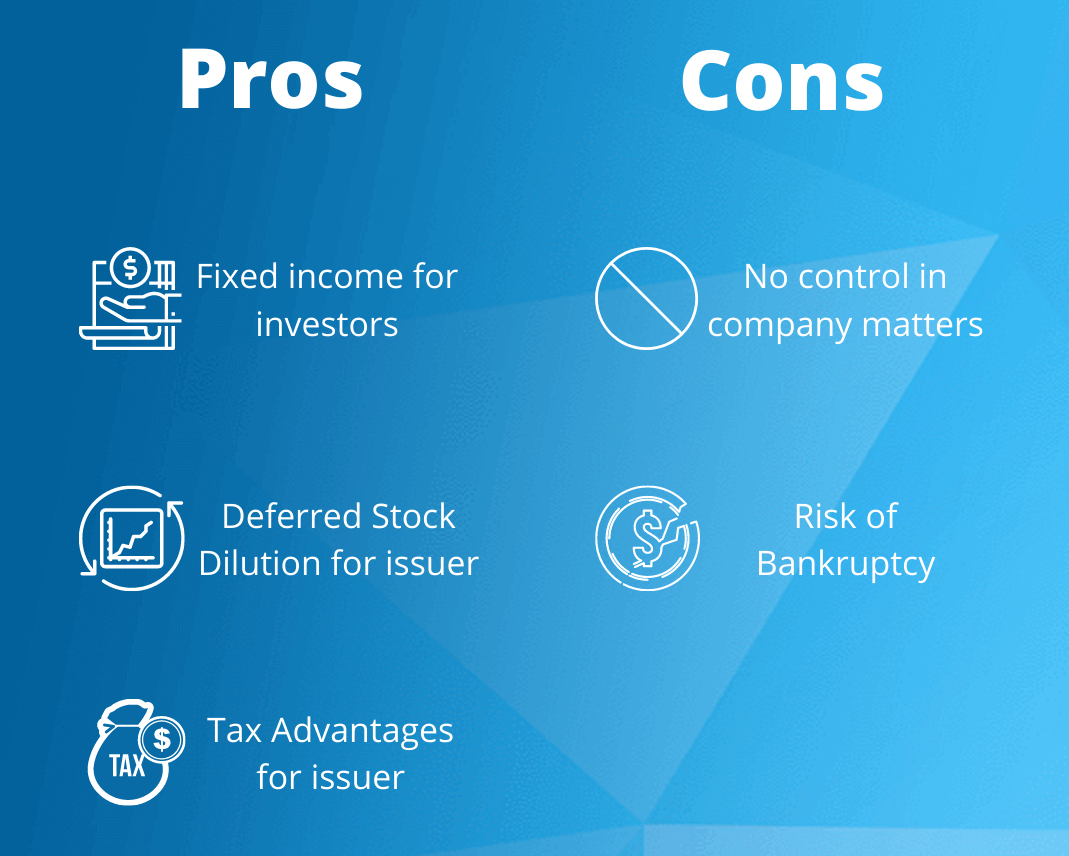

Advantages of Using Convertible Debt. Other disadvantages mirror those of utilizing straight debt although convertible bonds do entail a greater risk of bankruptcy than preferred or common stocks and the shorter the maturity the greater the risk. Ad Learn why conservative investing might not be as safe and prudent as it sounds.

If the normal bonds of Ensolvint were trading at 10 yields and the yield of the convertible was 10 bond investors would buy the bond and keep it at 100. Until the debt is converted into equity you must service the loan according to the terms of the agreement. Bullet bond is a simple debt instrument that pays its fixed coupons annually or semi-annually whilst the principal can be only redeemed at the maturity.

Thus the company is required to pay interest to its creditor. Advantages of Convertible Bonds. Firstly it is important to note that reverse convertible bonds provide a significantly higher yield as compared to regular bonds.

Ad Add Income and Capital Appreciation Potential to Your Investment Portfolio. Find Funds That Outperformed Peers. The advantage for companies of issuing CBs is that if the bonds are converted to stocks the companys debt vanishes.

If your business defaults on the loan the lender could take legal action against your business. Convertible bonds are safer for the investor than. The answer would be that the yield of the bond justified this price.

This also means that they are riskier than regular bonds. There is a risk of exchange as the interest is to be paid in foreign currency. A The value retained for the shares subsequently converted.

The advantages for investors in holding convertible bonds center on their ability to participate in the fortunes of the company without a direct equity holding. We will evaluate following types of bonds and their positive and negative sides. The advantages have been explained in detail in this article.

In other words if the exchange rate increases the issuer will have to pay more to the investors. In this article we will have a closer look at some of the advantages and disadvantages of using this form of debt. This is because it provides several advantages over plain vanilla debt bonds.

Find a Dedicated Financial Advisor Now. You might ask why the convertible was trading at 100 in this case. Visit The Official Edward Jones Site.

EPS or Earning Per Share rate of the stocks of a company go down when it introduces convertible securities. Read customer reviews find best sellers. The option to convert to stock is an enticement for investors to take positions in this security.

Retirees beware of this conventional wisdom. Ad Learn How to Get Started Investing With Bond ETFs. The few disadvantages which also accompany the advantages of convertible securities are listed below.

However there are many investors who have a. Advantages and Disadvantages Of Convertibles From the issuers perspective the key benefit of raising money by selling convertible bonds is a reduced cash interest payment. Lower Interest Rate - The benefit to the issuer of convertible bonds is that investors will accept a lower interest rate since there is potential price appreciation based on converting the bond if the stock price rises.

Because of the conversion option convertible debentures may pay a. Another negative point. Many companies continue to use convertible debt.

A convertible bond with an exercise price far. Companies reduce interest expenses due to lower interest rates. Companies avoid dilutive share.

Convertible bonds work like a traditional loan. You may be surprised about what you read. New Look At Your Financial Strategy.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. If it does not convert for example the company may be forced to repay the money within a very tight timeframe. The Disadvantages of Convertible Debentures.

Bonds advantages and disadvantages is a subject that has been quite often researched. Do Your Investments Align with Your Goals. Browse discover thousands of brands.

Invest Online or Over the Phone.

Convertible Bonds Efinancemanagement

Corporate Bonds Primer On Types Of Debt Securities And Features

No comments for "Convertible Bonds Advantages and Disadvantages"

Post a Comment